Your Reliable Fund Manager

RELI Capital has a 47 year long history of managing mortgage investments for our investors backed by Australian property security.

Our simple motto of ‘looking after your investments as if they were our own’ has attributed to our longevity. We have witnessed various market and economic cycles during which we have developed robust risk management processes and prudent credit policies to adapt to ever evolving trends, and make credit decisions based on fundamental lending principles.

We understand that choice, transparency and diversification are important to our investors and it is for these reasons that our investors entrust their money with us. The RELI Capital Mortgage Fund (“the Fund”) allows you to select one or multiple investments in loans secured by a first mortgage against specific properties in line with your risk appetite and strategy.

As a holder of an Australian Financial Services Licence, Australian Credit Licence, and as the responsible entity of a registered Australian Managed Investment Scheme for both retail and wholesale investors – aka the Fund – we are subject to stringent oversight by ASIC and regular independent audits, and accordingly have built a culture of sound corporate governance and compliance.

With our strong track record and extensive experience in mortgage lending, you can be confident that your money is being managed by a reliable and credible fund manager. Together with our personalised service and seamless experience, you can also be assured that unlike larger fund managers you won’t be treated as just another number.

Why RELI Capital

Our company has a strong track record backed by over 47 years of experience, providing proven performance across various market cycles. With our robust risk management processes, we maintain a prudent lending policy with predetermined interest rates. Moreover, we provide Australian property security, friendly and experienced customer service, and are registered and licensed with ASIC while being independently audited. Trust us to provide you with a reliable and secure investment experience.

What RELI Capital Offers

We offer individual investments in first mortgage loans secured by real estate, providing:

Interest Rates From 6.00% p.a*

Interest Paid Monthly in Arrears

No Entry, Ongoing Or Exit Fees

Investment Terms 18-36 Months*

Transparency And Choice Of Investments

A Historically Low Volatility Asset Class

Conservative Loan To Value Ratios

Direct Access To The Chief Investment Officer

How To Invest

Download and read our Product Disclosure Statement (PDS)

Complete our Offer to Invest and return it to us with your funds and identity verification.

We will allocate your funds to one or multiple investments for your selection.

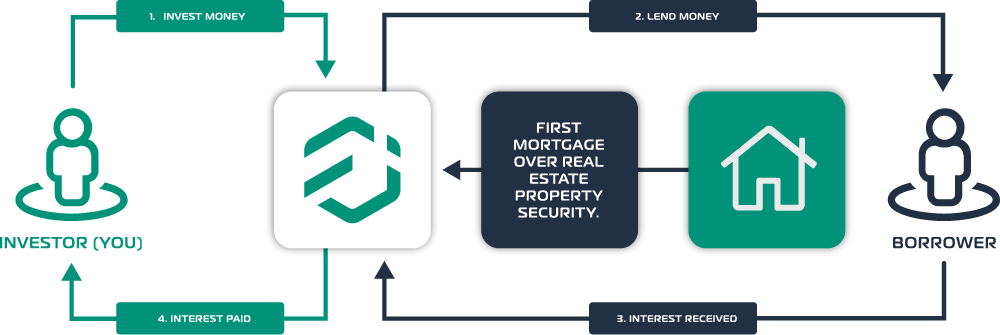

How It Works

FAQs

The interest rate payable to investors may be fixed or variable. The current variable interest rate starts from 6.00% p.a*.

At RELI Capital, we welcome a diverse range of investors who are looking to participate in our first mortgage investment opportunities. Our investment product is open to individual investors, self-managed super funds (SMSFs), corporate entities, and institutional investors. Whether you are an experienced investor or new to the market, we provide an accessible and reliable avenue for you to explore investment options backed by Australian property security, subject to your risk appetite and investment strategy.

The minimum investment amount to participate in our first mortgage investments is $10,000.

We understand the importance of prompt fund allocation and transparency in the investment process. When you invest with RELI Capital, your funds will be held securely in a designated trust account with a bank and paid the “at call” deposit rate until they are allocated to specific investment opportunities. We strive to allocate funds to suitable investments in a timely manner, enabling you to benefit from potential returns.

At RELI Capital, we offer a range of investment opportunities backed by Australian property security. By investing in our first mortgage investments, you can diversify your portfolio across various properties, locations, and borrower profiles.

A first mortgage is a first charge over real estate owned by a borrower. Our investments are secured by a registered first mortgage in the name of RELI Capital on behalf of the investors against Australian real property. If there is a default in repayment of the loan, the terms of the mortgage provide RELI Capital the right to take possession of and sell the property to recover the loan amount and repay investors.

The security property varies from loan to loan and can be residential (houses, townhouses, apartments, units), commercial (retail, office & light industrial) or rural properties as well as vacant land.

RELI Capital provides lending solutions to a diverse range of borrowers seeking non-bank finance for credible purposes. Our borrowers typically include sophisticated individuals, self-employed business owners, property developers, and special purpose corporate entities who are often bank worthy but may not, for example, currently conform to strict bank lending criteria or who require fast settlement turnaround times, are disenchanted with the banks or desire flexible loan covenants. We thoroughly assess each borrower’s financial position, creditworthiness, and exit strategy to repay the loan as well as the property offered as security for the loan.

RELI Capital takes pride in offering investments with no entry, ongoing, or exit fees. This means that investors will be paid without deduction from the pre-determined interest rate as all fees are paid by the borrowers.

Loan to Valuation (LVR) is a financial term used to assess the ratio between the loan amount and the appraised value of the property securing the loan. It helps gauge the level of risk associated with the loan. At RELI Capital, we evaluate the LVR for each first mortgage investment opportunity to ensure that the loan advance does not exceed 66.66% of the ‘as is’ value of the security property on all properties. This conservative LVR approach helps mitigate potential risk of capital loss and provides our investors with comfort as there is a considerable margin for error in the event that the borrower defaults and RELI Capital has to sell the security property to recover the loan.

RELI Capital is a registered and licensed boutique fund manager in compliance with the regulatory requirements of the Australian financial industry. We hold an Australian Financial Services License (AFSL) issued by the Australian Securities and Investments Commission (ASIC). This license allows us to operate a registered mortgage investment scheme and offer first mortgage investment opportunities to our valued investors. Our commitment to regulatory compliance ensures transparency, professionalism, and investor protection throughout our operations.

The interest rate for our first mortgage investment opportunities is determined based on various factors. These factors include the type of security property, the loan-to-value ratio (LVR), the creditworthiness of the borrower, the term of the loan, prevailing market conditions, and the overall risk profile associated with the investment opportunity. Our experienced team conducts comprehensive assessments to ensure that the interest rates offered provide our investors with competitive returns adjusted for the associated risks involved.

A contributory mortgage fund is a type of investment vehicle whereby one or many investors can contribute to a loan that is made to a particular borrower and is secured by a first mortgaged registered against a specific property. Each loan is separate from any other loan and is therefore not a ‘pooled’ fund.

As with any investment, there are inherent risks associated with first mortgage investments. These risks include property market fluctuations, borrower default, interest rate changes, and general economic conditions. At RELI Capital, we mitigate these risks through rigorous due diligence, careful assessment of investment opportunities, and diversification of our portfolio. While we strive to minimise risks, it’s important to note that past performance is not indicative of future results. For full details of the investment risks applicable please refer to our PDS and seek independent financial advice before making any investment decisions.

Target Market Determinations

Under our Australian Financial Services Licence that is regulated by the Australian Securities and Investment Commission (ASIC) we are required to display our Target Market Determination (TMD) for the Fund.

The TMD outlines the target market that the Fund is designed for after considering several key consumer attributes and forms part of RELI Capital’s design and distribution obligations.

Important Information

*Rate current 1 February 2026. There is a risk that investors may achieve lower than expected returns. RELI Capital investments are not bank deposits, and investors risk losing some or all of their money. Generally there is no right of early withdrawal prior to maturity of the investment term and there is a risk that redemption at maturity may be delayed. Before deciding to invest consider RELI Capital’s PDS and TMD.

For full details of the Investment Risks applicable to the Fund please refer to the PDS and the Investor Disclaimer page.